Fintech Investing in Q4 and Beyond – What to Look For

Mark is the head of research for Covenant Venture Capital. Mark is also an early-stage VC investor and advisor to venture and growth equity PE funds. He has significant experience in investment analysis and due diligence across multiple industry verticals to include software, platforms, media, technology, and mobility companies. Mark's experience also includes investment banking and strategy consulting at Goldman Sachs, PIMCO, RBC Capital Markets, and Accenture Strategy. Since 2015, has advised and led the structuring and sale of over $5.9B in securities, and $34M in invested capital. Mr. Mitchell also has advised and led strategy engagements for F50 companies in go-to-market strategies, market sizing, and product market fit. Mark is a Veteran of the United States Army 2005 - 2016.

For the first time since the beginning of 2021, Fintech is no longer the leading industry by investment as it has been surpassed by Healthcare ($16.7B). Despite a 64% downturn in global investments since Q4 2021, $13.3B has still found its way to Fintech startups in Q3 2022. Fintech investors are becoming more discerning as a result of global macroeconomic conditions, and while there is still money out there for Fintech startups, companies unable to demonstrate how they will turn a profit or adapt to regulatory shifts will find themselves increasingly shut out from investments.

Interestingly, as funding dries up in later-stage deals, investors are seemingly moving down the curve to earlier-stage deals which are much smaller in comparison (but much riskier). The median seed-stage deal has grown 33% from $2.4M in Q3 2021 to $3.2M in Q3 2022. During the same time period, the median Series A deal is down 6% from $10.9M to $10.2M, the median Series B deal is down 46% from $37M to $20M, and the median Series C+ deal is down 62% from $91M to $35M. Similar to the shift in priorities witnessed in the public markets from growth to gross margins, there is a new focus and expectation on profitability in venture investing.

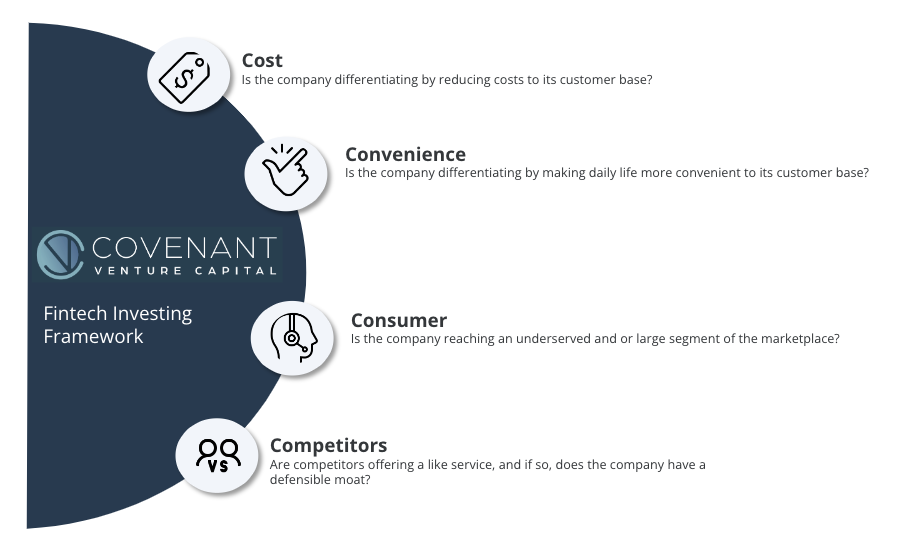

Simplified Framework to Assess Fintech Investments

While there is no magic formula to find the right Fintech investment for your portfolio, it is never impractical to go back to the basics when deciding on companies to invest in.

Does the company have a strategy to scale? Does it have the ability to win and keep customers? Is this company performing an essential service to its customers? Is this company competitively priced? Will this company consistently be a top choice among its peers? Ultimately, investors are looking to understand the value proposition of the Fintech and the likelihood of profitability, so questions that should be asked include:

- Cost – how much does it cost to use the services offered by Fintech versus alternatives in the market? If a Fintech can perform a similar function faster and cheaper than peers without sacrificing quality, then it may have optimized operations and costs which are all positives for profitability.

- Convenience – how does this Fintech improve the lives of customers? And how inconvenient would it be to switch to another solution? Fintech companies initially differentiated themselves by nimbly tackling challenges that large financial institutions were too slow to solve (PayPal, Stripe, Venmo, Robinhood, etc.). If a Fintech is cutting down blockers and layers of bureaucracy for the customer, then it will significantly reduce barriers to adoption.

- Consumer – who are the end users of this Fintech and how large is this group? While most startups will attempt to serve the largest consumer segments to increase their TAM/SAM/SOM, there is a case to be made to pursue underserved segments. For example, marketplace lending platforms serving SMB/SME business loans (Lendio, Fundera, OnDeck, etc.) have found considerable success servicing business loans where 60% of customers want loans below $100,000. Digitization decreases costs to service these loans, which are cost-prohibitive to larger banks, making the segment ripe for disruption (until larger banks catch up).

- Competitors – what are the other choices in the market and how are they different? If a differentiator cannot be identified by or in a Fintech, then they will eventually be beaten in cost and or efficiency. Many companies claim to have AI, but humans are still turning the gears from within the black box. While this may work for the short term, it is not an effective long-term strategy for profitability. If a Fintech is not faster, more efficient, more cost-effective, or of higher quality than its peers, then be wary of its claimed value proposition.

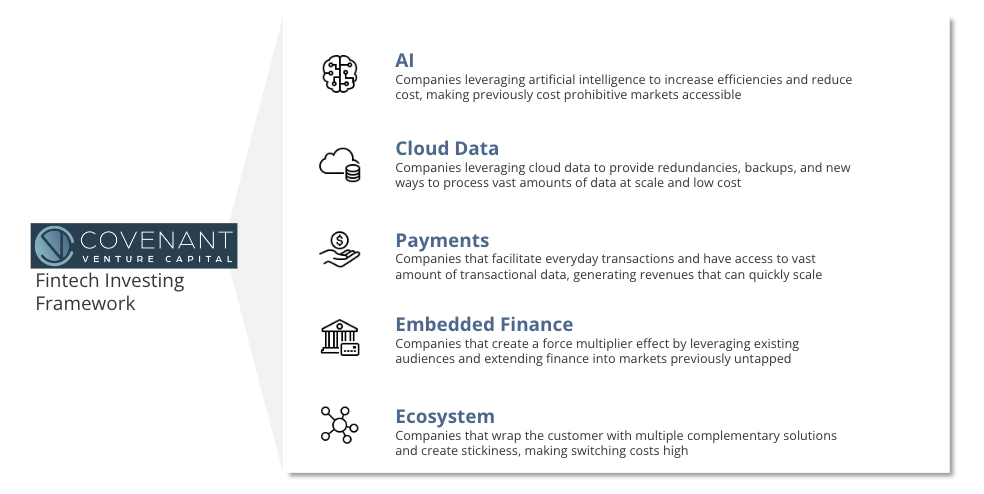

What Kind of Fintech Investments are Compelling?

In our view, there are three things Fintech companies should be doing and doing well: (1) optimizing business processes; (2) facilitating continuous interaction with the marketplace; and (3) scaling a solution with a force multiplying effect. The below subsets of Fintech do one or more of these which in turn supports the profitability thesis.

AI/ML – according to a Bain report, the gap between top performers and other companies in people’s time, talent, and energy has widened during the pandemic. AI and ML have allowed for substantial gains in data analysis, cost reduction, process automation, and improved customer experiences. One of the major hurdles faced by large financial institutions is the amount of human capital required to perform many of the routine and redundant tasks in banking. This is partially why for large banks it costs the same amount of time and effort to process a $1,000,000 loan as it does a $100,000 loan. Whereas in the past, an increase in loan origination would require a subsequent increase in headcount to process loan documents, the ability to automate and reduce manual work through AI can create the possibility of maintaining throughput with a flat headcount. AI/ML solutions should be an automatic criterion for Fintech investing in this economic climate.

Cloud Data – core legacy financial systems cannot scale sufficiency and require significant time, effort, and team sizes to maintain system infrastructures. According to a McKinsey report, cumbersome systems also have high error rates, poor refresh rates, and provide suboptimal user experiences from stitching together data and services across multiple siloes. Cloud data reduces IT overhead costs and enables the environment for complex data processes, which is essential for automation, insights, and enhanced experiences. Companies ushering in cloud data and security to financial services will play a critical role in advancing the capabilities of banks in the future.

Payments – despite macroeconomic challenges in the market including a 43% reduction in VC funding, Payments continues to lead Fintech funding by sector in Q3 2022 ($3.4B) and according to McKinsey, generated $1.9T globally in 2021. The Pandemic has accelerated the shift in payment behaviors as we see a decline in cash payments, the adoption of contactless cards, and migration from in-store to e-commerce. New form factors and faster payments are making this segment even more attractive, and even Goldman Sachs has taken notice as they expressed interest in buying Fintechs that could help build out their credit-card capabilities.

Embedded Finance – embedded finance has already accounted for $2.6T, or nearly 5% of total U.S. transactions in 2021. Bain estimates that by 2026, this number will exceed $7T and over 10% of total U.S. transaction value as demand will continue to grow. At its core, embedded finance integrates financial services into non-financial websites, mobile applications, and business processes which effectively leverages existing customer relationships versus building new banking relationships. This strategy reduces customer acquisition costs by nearly half and increases ROA and ROE versus banks that do not have embedded finance. Fintech-enabled marketplaces have median EV/Sales of 6.7x versus online marketplaces (5.3x) and financial services (4.6x) making embedded finance Fintechs an attractive investment.

Platform or Ecosystem – the new value chain is platform-driven, and connecting multiple platforms can expand ecosystems. Traditional banking generally siloed customers and offered them a limited suite of solutions whereas modern Fintech platforms and ecosystems wrap the consumer with a suite of services that are complimentary. The holy grail for platforms beyond MAU/DAU is high engagement rates. That is, it is not enough to spend time on a platform, users should be performing actions that generate revenue. Finance apps flew past the 500M mark in the U.S. in 2021, and 82% of smartphone users used finance features at least weekly. Top finance activities included checking account status, making payments, transferring money, receiving quotes, and making trades. By extending the use case of the platform beyond traditional banking, Fintechs can keep users more engaged, solve more pain points, and in the end, generate more transaction revenue.

Finding the Balance

Fintech continues to be an exciting space with tremendous opportunities for upside, but this enthusiasm should be tempered with a disciplined investment philosophy targeting profitability over growth, at least in the current market environment. It will be important for investors to strike the balance between pre-recession growth-centric investing strategies with one that actively seeks efficient operations and airtight cost controls. By finding the sweet spot, investors can significantly de-risk the valuation crunch currently being experienced in the market and position themselves for the eventual return of IPOs.

If you'd like to sign up for our weekly newsletter, please fill out the form below.